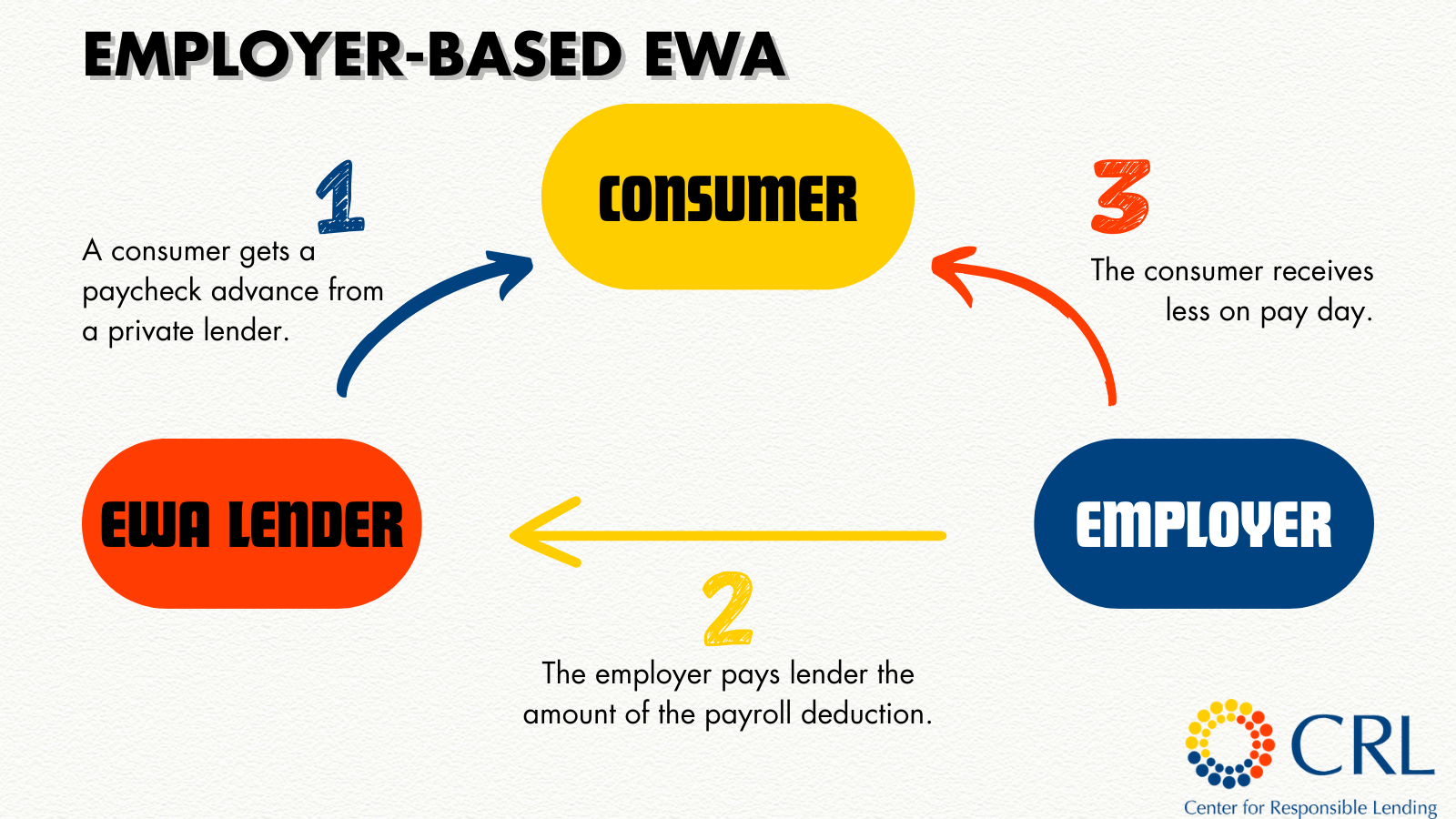

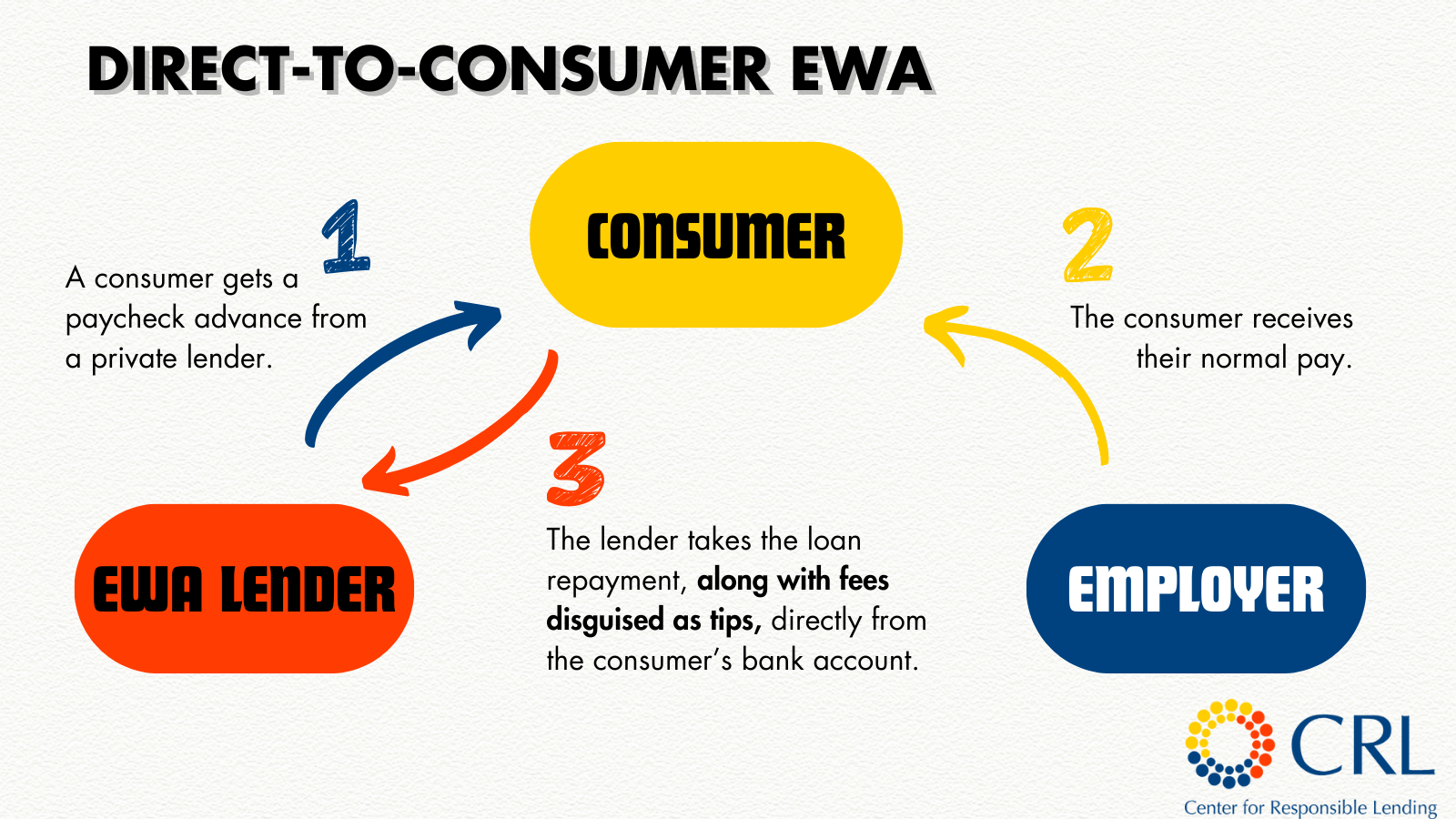

Payday loan apps offer small, short-term loans that are typically repaid on the consumers’ next payday. These products are sometimes called Earned Wage Advance, Early Wage Access, or EWA but few merit this name. Research by CRL and others has demonstrated using these apps leave many consumers worse off - paying high fees for small loans, increasing their risk of overdraft, and having to reborrow paycheck after paycheck. Regulators should enforce credit laws to increase transparency and to protect consumers' paychecks from being eroded by fees and tips.

The Payday Loan App Model - Users Generally Do Not “Access” Their Own Earned Wages

CRL Resources

- Nickel and Dimed: How Payday Loan Apps Drain Workers’ Pay and How to Stop Them

- State-by-State Action on Payday Loan Apps

- Escalating Debt: The Real Impact of Payday Loan Apps Sold as Earned Wage Advances (EWA)

- A Loan Shark in Your Pocket: The Perils of Earned Wage Advance

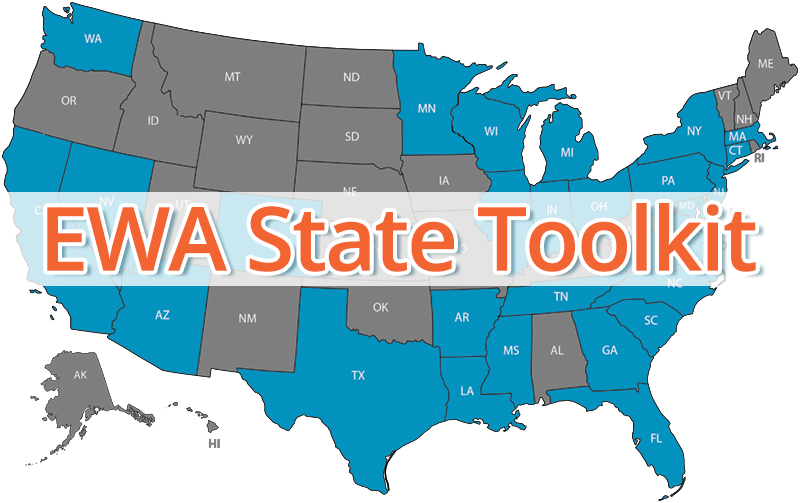

- Payday Loan App State Toolkit

- Paying to be Paid: Consumer Protections Needed for Earned Wage Advances and Other Fintech Cash Advances (Updated: October 2024)

- One-page Primer - Payday Loan Apps: States Should Regulate As Credit, Protect Consumers (Updated: September 2025)

- Not Free: The Large Hidden Costs of Small-Dollar Loans Made Through Cash Advance Apps

- State Policy Recommendations for Earned Wage Advances and Other Fintech Cash Advances

- Survey Summary of Earned Wage Advance and Cash Advance Apps

- Advocates: CFPB Should Stop Paycheck Advance Apps From Hiding Junk Fees and Other Costs From Consumers

- Video: Earned Wage Access is Credit (In Focus Series #3)

Additional Resources

- Data Spotlight: Developments in the Paycheck Advance Market, Consumer Financial Protection Bureau

- Financial Technology: Products Have Benefits and Risks to Underserved Consumers, and Regulatory Clarity Is Needed, U.S. Government Accountability Office

- 2021 Earned Wage Access Data Findings, California Department of Financial Protection and Innovation

Payday Loan Apps in the News

- Video: The costs and pitfalls of ‘earned wage access’ apps that offer loans between paychecks, PBS Newshour

- These apps allow workers to get paid between paychecks. Experts say there are steep costs, Associated Press

- Earned-Wage Access Firms Rile Regulators With Customer Tips, Bloomberg

- What to Know About Online Paycheck Advances and Why They Face Scrutiny, New York Times

- Earned wage access apps: loans or financial services?, Pluribus News

- Not-so-easy money: Report details hidden fees in cash app loans, Wisconsin public radio station (WXPR)

- Consumers Face Hidden Fees Using Paycheck Advance Apps, New Analysis Reveals, Black Enterprise

- States must protect consumers from high-cost fintech cash advances, American Banker (subscription required)

- Will California crack down on cash apps that trap women in debt?, Los Angeles Times

- The new payday loans? California moves to regulate cash advance apps, CalMatters

- Florida politicians may unleash the next generation of payday lenders, Seeking Rents

- Why so many people are paying to get their paychecks, Vox

- New State EWA Legislation—An Act Of Misplaced Trust and Faith?, FlexWage (Op-ed. from EWA company criticizing industry-backed EWA bills as harmful to consumers)