Payday loans—high-cost, quick-fix loans that trap borrowers in debt by design—cost cash-strapped American families $3.4 billion in fees every year. Of that number, more than two-thirds—$2.6 billion--is a direct result of churning borrowers into loan after unaffordable loan. This churning dramatically increases payday lending fees without providing borrowers with access to new credit.

Payday loans have multiple features that make them dangerous for borrowers: a lack of underwriting for affordability; annual percentage rates (APR) averaging 300%; a quick repayment period of their next payday, at which time the loan is due in full; and collateral provided by personal check, which gives lenders direct access to borrower bank accounts. Further, payday loans are simply unaffordable: A typical payday borrower making $35,000 annually does not have enough income to repay their loan and cover other monthly expenses, and subsequently is caught in the payday lending debt trap for months at a time.

Twenty-two states, including the District of Columbia, have significantly curbed this debt trap for their residents, either by eliminating predatory payday lending altogether, or by limiting the number of loans a borrower may take out in a year. CRL's latest findings—including that 85% of payday loans go to borrowers with seven or more loans per year—underscore long-term, repeat borrowing as the core of the payday lending business model. The time to stop debt-trap lending is now, and the report concludes with recommendations for ways state and federal policy makers can do so.

Payday Borrower Consequences [Graphic]

From losing your checking account, to filing bankruptcy, borrowing from a payday lender increases the likelihood of a range of harmful outcomes, and creates lasting financial troubles.

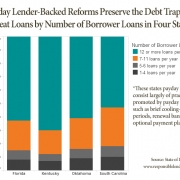

Repeat Borrowing in Four States [Graphic]

In states that have passed payday lender-backed laws, including practices like brief cooling-off periods, renewal bans, and optional payment plans, a high percentage of new payday loans go to borrowers with twelve or more payday loans a year.