October 1, 2021 – December 31, 2021

Over the course of nearly 20 years, the compelling case for CRL’s recommended policy solutions has mobilized consumer advocates, engaged state and federal elected officials, and influenced regulatory action. Highlights from Fourth Quarter 2021 include:

- Our student loan experts combined research reports and data, a documentary film and advocacy, and live events to promote student debt cancellation;

- This team also helped gain increased federal funding for HBCUs;

- and secured income-driven repayment program improvements.

Years of anti-payday lending advocacy in states led to the introduction of a federal 36% rate cap bill, and the Consumer Financial Protection Bureau (CFPB) is examining emerging small dollar threats, while CRL-backed down payment assistance as part of the federal COVID response remains in play.

As HBCUs are Celebrated, For-Profit Institutions’ Poor Performance is Revealed

Historically Black Colleges and Universities (HBCUs) serve as vital institutions of higher education that produce more than 130,000 jobs and almost $15 billion annually in total economic impact. A study conducted by CRL, United Negro College Fund, and UNC’s Center for Community Capital into the experiences of Black students at HBCUs launched in November. CRL simultaneously released the “My Yard, My Debt: The HBCU Student Borrower Experience” documentary featuring firsthand accounts.

Watch the entire “My Yard, My Debt: The HBCU Student Borrower Experience” documentary at MyYardMyDebt.org.

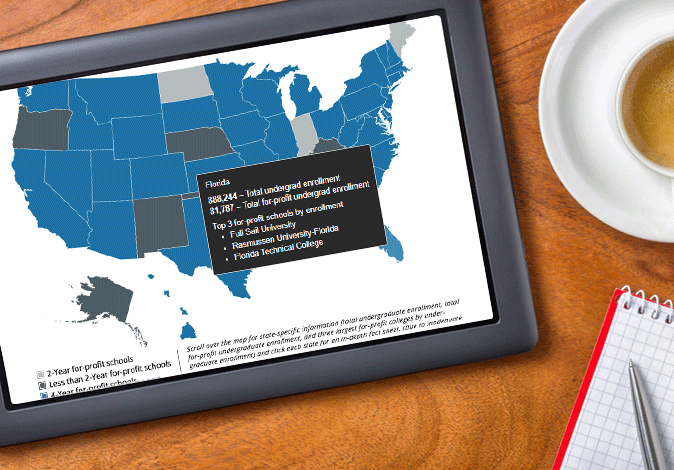

A virtual panel In October entitled, "Black America: Examining the HBCU Student Loan Experience" was moderated by CRL’s Jaylon Herbin. NAACP CEO Derrick Johnson, NC Congresswoman Alma Adams, and others joined him. CRL’s annual The State of For-Profit Colleges Interactive Map and State Fact Sheets analysis of Department of Education College Scorecard data highlighted state-by-state figures on disparate impact and poor for-profit performance.

Click on the image above to explore the interactive map of For-Profit Colleges.

Debt Collection Abuses Scrutinized by CRL Experts

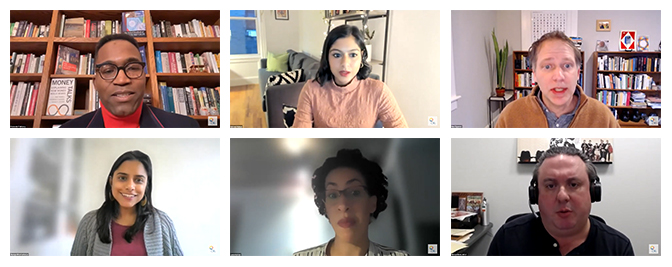

We’ve sounded the alarm over wage garnishment—a growing threat to low- and moderate-income households and families of color— as a debt settlement method. On December 15th, CRL hosted the Economic Policy Institute, Groundwork Collaborative, and the Insight Center, and National Consumer Law Center for a panel discussion on the emerging national movement to protect $1,000/week from wage garnishment.

Fintech lender Oportun withdrew its national bank charter application under pressure from CRL and consumer advocates in early October. This significant victory is the result of CRL and CA allies’ work exposing Oportun’s history of targeting Latinos and immigrants with unaffordable loans and predatory debt collection practices. The company has been under investigation by the CFPB for a year. CRL found that Oportun was among the top filers of debt collection cases in Los Angeles County n from 2018 through 2020, affirming other research that showed Oportun’s position among the top filers of debt collection lawsuits in both California and Texas.

(December 15 panel participants from top left) Princeton Professor Fred Wherry (Moderator); Rakeen Mabud, Groundwork Collaborative; Ben Zipperer, Economic Policy Institute; (bottom row from left) Jhumpa Bhattacharya, Insight Center; Lucia Mattox, CRL; and Michael Best, National Consumer Law Center discuss the national movement to protect $1,000/week from wage garnishment, and how that intersects with other racial and economic justice fights.

New Year Ushers in Long-Awaited Federal Rate Cap Bill, But BNPL Looms as Consumer Threat

The bipartisan Veterans and Consumers Fair Credit Act, introduced in mid-November by Congressmen Jesús “Chuy” García (D-Ill.) and Glenn Grothman (R-Wis.), would limit the interest rate on consumer loans to no more than 36% APR. Backed by CRL, its provisions would extend existing interest rate limit protections currently in place for active-duty military servicemembers and certain dependents to veterans and all other Americans.

In other small dollar work, CA Policy Director, Marisabel Torres called for regulation of Buy Now Pay Later (BNPL) and other fintech products in November 2 testimony before the House Financial Services Committee’s Task Force on Financial Technology. Concern about BNPL affordability expands to Earned Wage Access (EWA) loans – those actually integrated with the employer and repaid only via deduction from future pay. CFPB announced an inquiry into BNPL on December 16 and provided news consumers can use during the holiday season.

Watch Marisabel Torres testify before the House Financial Services Committee’s Task Force on Financial Technology.

COVID Presents Ongoing Challenges in Addressing the Racial Wealth Gap and Homeownership Opportunities

As this update is drafted, the Build Back Better reconciliation bill still includes the proposal for first- generation, first-time homebuyer down payment assistance—with $10 billion of funding. We’ve stood alongside civil rights partners in advancing this important provision. CRL and our affiliate, community development lender Self-Help, are carefully considering longer-term homeownership strategies to reduce the racial homeownership and wealth gaps. We submitted two mortgage-specific comment on October 25: one on Federal Housing Finance Agency’s Enterprise Equitable Housing Finance Plans, and the second (in collaboration with Americans for Financial Reform and the National Community Stabilization Trust) on the Government Sponsored Enterprises (GSE) Affordable Housing Goals.

What Are CRLers Reading and Listening to?

We’ve shared the following resources with each other to extend our knowledge on issues of economic justice:

- Tense Negotiations of Income-Driven Repayment Plans for Student Loans Continue – Diverse Issues in Higher Education

- Lawmakers revive effort to enact national interest rate cap – American Banker

- What the 2020 census can and can't tell us about race: Code Switch – National Public Radio

- Overdraft fees are a menace – The Washington Post

- This big bank is getting rid of overdraft fees, saving customers $150 million a year – The Arizona Republic

Student Borrowers Receive Reprieve from the Biden Administration in late December

CRL’s advocacy was instrumental in the Biden Administration’s decision to extend the federal student loan payment pause until May 1st, 2022. The extension is a critical step toward restoring economic stability for borrowers and their families, especially in light of COVID. Our current ask is that the Administration provide more permanent and substantial student loan relief in the form of $50,000 cancellation per borrower. Our hope is that debt cancellation is realized in 2022.

Stay in Contact

Thank you again for your support of CRL. We could not do this work without you.

Please feel free to reach out to CRLPhilanthropy@responsiblelending.org if you have any questions, comments, or concerns. We would love to hear from you.