Six years after the Great Recession, American households continue to struggle with consumer debt. According to data reported by the Urban Institute, approximately 77 million Americans – 35 percent of adults with credit files – have debt in collections reported on their credit files. These Americans carry about $1,349 in debt. About 31 percent of Colorado residents have debt in collections.

- Debt buyers purchase bad debts that were written off by the original creditor. They pay pennies on the dollar and try to collect the full amount. But they have so little information about the underlying transactions and payment history that they frequently pursue the wrong person, or try to collect the wrong amount or pursue a debt that is not owed, or was already paid.

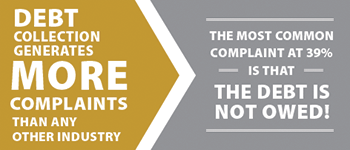

- Debt collectors generate more complaints by consumers than any other industry, both at the national level and in Colorado. The most common complaint is for continued attempts to collect debts not owed. The most commonly complained about debt collectors are debt buyers.

- Debt buyers flood the courts with lawsuits, though they have limited information about the claims they make. They count on the fact that most people will not hire a lawyer or defend the suits for themselves. When this occurs, they get “default judgments”—meaning a judgment in their favor without the person sued having mounted a defense. A review of 375 randomly selected cases filed by four debt buyers in the county courts in five Colorado counties from 2013 through 2015 revealed that 71 percent of the cases resulted in default judgments against the individuals sued. It is exceedingly rare for an individual to be represented by a lawyer in these cases—and the consequences can be severe. Of the 375 cases in our sample, 38 percent resulted in the garnishment of the individual’s wages to satisfy the alleged debt.

- Debt buyers burden the Colorado courts with these cases. State-wide, cases filed by four large debt buyers alone accounted for over eight percent of all civil cases filed. The taxpayers thus end up footing the bill for a large part of the debt buyers’ collection strategies.

- States are increasingly implementing policies by statute or court rules to address this problem. These include requiring debt buyers to provide more thorough and accurate information to the individual pursued for collection, and when the debt buyer sues, provide the court with documentation from the original creditor to support the debt. Colorado has not yet done so, but recently released findings by the Colorado Department of Regulatory Agencies support the possibility of doing so in the coming year.